r&d tax credit calculator 2019

And we do not want to stop here without helping you. Let our experts research and.

Freed Maxick Guide To The Federal Research And Development Tax Credit Freed Maxick

What is the RD tax credit worth.

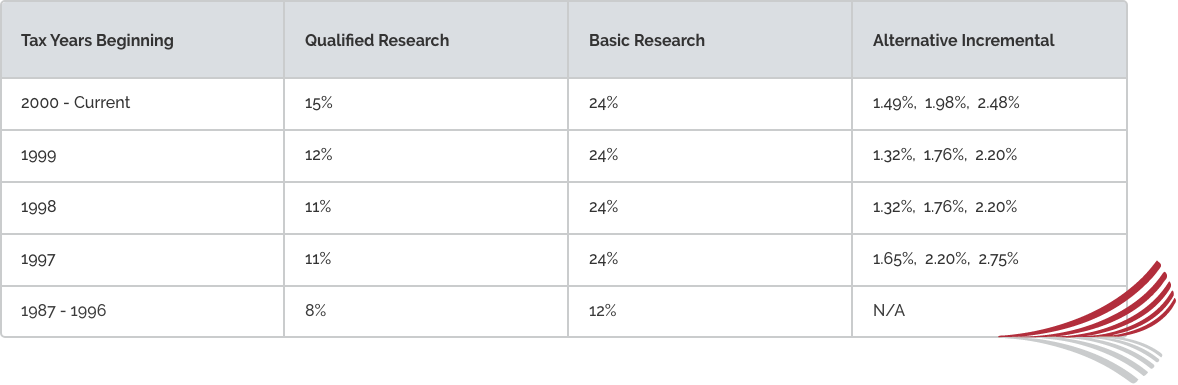

. This credit appears in the Internal Revenue Code section 41 and is. Use Titan Armors calculators to estimate your state and federal RD tax credit benefits or to see if you can offset your payroll tax. For most companies the credit is worth 7-10 of qualified research expenses.

RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income. This calculator has been developed utilizing data from a variety of studies.

The Kruze Consulting RD Tax Credit Calculator is designed to estimate your RD tax credit using Federal Form 6765. We will show you how. Its easy and free.

Calculating RD relief for an SME depends on whether your business is profit- or loss-making. How to calculate RD for SMEs. This is a dollar-for-dollar credit against taxes owed.

Thats a 1200 savings. The RD tax credit calculation can be done under the regular research credit method or the alternative simplified credit. For profit-making businesses RD tax credits reduce your.

Let Kruze Consulting handle your startups RD Tax Credit analysis and. The UKs most accurate RD claim calculator. Risk free no obligation.

Having used RDvaults platform to complete the past 2. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Discover the UKs 1st RD Tax Credit Claim Estimator 90 Accurate Real-time.

Tax credits calculator - GOVUK. The results from our RD Tax Credit Calculator are only estimated. Estimate your tax savings using our quick.

In 2021 alone alliantgroup delivered over 23 billion in credits and incentives to over 14000 businesses. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Gusto customers receive 12 months of Gustos Real Time Credit Tracker completely FREE.

Enter Current Year Total Wages Average Annual Growth over prior 3 years Projected net federal credit. This allows you to utilize your RD tax credits to offset your payroll each. RD Tax Credit Calculator.

Plus it carries forward. The RD tax credit is now permanent and for the first time ever small businesses and start-ups can take advantage of this lucrative tax credit.

Easy Solar Tax Credit Calculator 2021

Arc Ic In 2019 Release Of A 2019 Arc Ic Payment Calculator Farmdoc Daily

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Tips For Software Companies To Claim R D Tax Credits

Tax Credits Georgia Department Of Economic Development

California R D Tax Credit Summary Pmba

R D Tax Credit Learn How Research And Development Tax Credits Work Endeavor Advisors

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

R D Tax Credits Find Out How Research Development Tax Credits Work

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

R D Tax Credit Guidance For Smes Market Business News

Quick And Easy R D Tax Credit Calculator Eide Bailly

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

About The Employee Retention Tax Credit Ertc Clarus R D

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

Easy Solar Tax Credit Calculator 2021

What Is The R D Tax Credit Ardius

Scott Orn Kruze Consulting On Twitter How Much Can Your Startup Save In Payroll Taxes Estimate Your R Amp D Tax Credit Using Our Free Calculator Https T Co Kprwco61gt Https T Co Lvvx4cbppv Twitter

R D Tax Credit Explained 2022 Tax Credits Calculation With Free Calculator Check Your Eligibility Youtube